POS System with Accounts Receivable

QuickBooks Accounting Integration

Automated Sync between Realtime POS and QuickBooks

POS Accounts Receivable with QuickBooks Integration

Streamlining Realtime POS Accounts Receivable with QuickBooks Integration

Efficient management of accounts receivable (AR) is a critical component of maintaining healthy cash flow and overall financial stability for any business.

QuickBooks, a leading accounting software, offers robust tools for integrating AR processes with our Retail POS System, allowing businesses to automate and simplify their invoicing and collections workflows.

Here’s a summary at how Realtime POS accounts receivable integrates with QuickBooks and the benefits it provides.

What Is Realtime POS Accounts Receivable Integration?

Accounts receivable integration facilitates the seamless connection between a company’s Accounts Receivable processes and its accounting software, in this case, QuickBooks.

This integration facilitates the synchronization of key data, such as invoices, payments, and customer information, ensuring accuracy and efficiency in financial management.

Pairing a retail POS system and QuickBooks, it offers a unified platform for managing sales and receivables.

Integrating with QuickBooks and retail POS systems is a strategic move for businesses aiming to optimize their financial operations. By leveraging its comprehensive features, companies can enhance efficiency, improve cash flow, and deliver superior customer experiences. As financial management continues to evolve, tools like QuickBooks remain indispensable for modern businesses.

POS Accounts Receivable Integration with QuickBooks

Automate Invoices

Accounts Receivable charges/Invoices are sent from Realtime POS to customers, the Invoice summary total is sent to QuickBooks. Invoice details are accessed from Realtime POS.

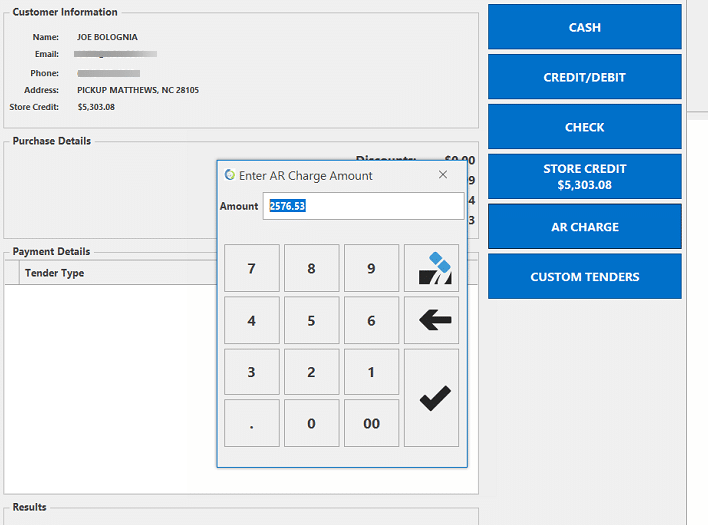

Setup the customer as AR approved, set their limit and customer can charge at the POS and charges are sent to QuickBooks in the customer ledger as a journal entry.

Customer Management

Realtime POS Maintains the customer records and any new customers added in Realtime POS will be sent to QuickBooks.

QuickBooks centralizes customer information, making it easy to access contact details, payment history, and transaction records. This consolidated view supports better customer relationship management.

Payment Tracking

The integration enables real-time tracking of payments, providing insights into outstanding balances and overdue invoices. This feature helps businesses maintain a clear picture of their cash flow.

Find the customer record in Realtime POS and apply a payment towards their account in POS. Payments are sent to QuickBooks on customer ledger as a jopurnal entry.

Better cash flow management

By automating the invoicing process and providing real-time updates on payments, a POS system can make it easier for businesses to manage their cash flow.

Store Sales Summary

Once a day at the end of the day each stores sales summaries are sent to QuickBooks as journal entries along with cost of goods sold, taxes and discounts so you have a accurate daily sales ledger for each store in QuickBooks online.

Payment Integration

Payments are processed in Realtime POS. Realtime POS integrates with Shift4 Payments gateway.

Customers can pay invoices using credit cards, ACH transfers, or any other custom tenders. This convenience accelerates the payment process.

Auditing and Reporting

Internal reports in Realtime POS will list out all sent batches and any errors will be logged in the error report.

Item Receiving

Purchase order receiving are sent to QuickBooks online as a payable entry in the supplier ledger.

Even on partial receiving. Keeps the vendor payables ledger accurate based on what was received from the original purchase order.

Runs as a Service

Runs as a service on the server regardless of computers running or not. No Exports and Imports, once setup will sync automatically.

Benefits of Integrating Realtime POS Accounts Receivable with QuickBooks

Improved Accuracy

Automation reduces manual errors in data entry and calculations.

Time Savings

Streamlining AR processes frees up time for businesses to focus on other priorities.

Enhanced Cash Flow Management

Real-time insights into receivables ensure businesses can make informed financial decisions.

Customer Satisfaction

Efficient and accurate invoicing, along with convenient payment options, enhances the customer experience.

Compliance and Reporting

QuickBooks provides tools for generating AR reports, helping businesses stay compliant with tax and regulatory requirements.

Simplified

Customer purchase details and account charges are located in RealTime POS, Customer Accounts Receivable charge summaries are located in QuickBooks.

Separating the two systems gives you a clear picture of product sales and customer details in Realtime POS and Customer Balances and Accounting in QuickBooks.

Book a FREE Demo Today!

Discover how RealTime POS can help you streamline your operations and improve your bottom line.

Your Demo will include a customized walkthrough of Realtime POS catered to your company’s unique needs.